RPA Automation

Challenge

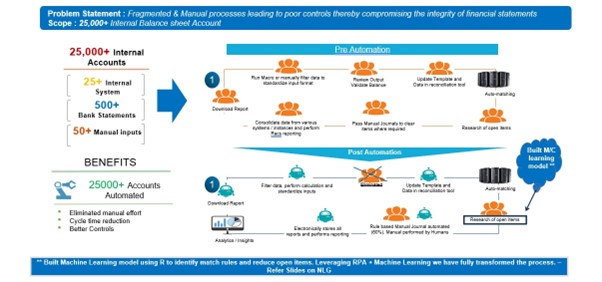

The bank faces the challenge of fragmented and manual processes, leading to poor controls and compromising the integrity of financial statements. Specifically, there are over 25,000 internal balance sheet accounts that require regular monitoring and reconciliation.

Action

The bank implements Robotic Process Automation (RPA) to address these challenges and automate the monitoring and reconciliation of internal balance sheet accounts.

- Process Assessment: Conduct a comprehensive assessment of the existing processes, including the identification of manual tasks and pain points.

- RPA Tool Selection: Evaluate and select a suitable RPA tool that can handle the complexity and scale of the bank's processes.

- Process Design: Design the automated process flow, including the steps for data extraction, reconciliation, validation, and reporting.

- Data Extraction: Develop automated mechanisms to extract data from various sources, such as ERP systems, spreadsheets, and databases.

- Reconciliation: Implement RPA bots to perform the reconciliation of internal balance sheet accounts, comparing data from different sources and identifying discrepancies.

- Exception Handling: Configure the RPA bots to handle exceptions and errors encountered during the reconciliation process, triggering notifications or manual interventions when necessary.

- Reporting and Analytics: Generate automated reports and dashboards to provide insights into the reconciliation results, highlighting any significant variances or trends.

- Monitoring and Maintenance: Establish ongoing monitoring and maintenance processes to ensure the RPA bots are functioning correctly and address any issues or updates as needed.

Results

The implementation of RPA automation brings substantial benefits to the bank's financial processes:

- Enhanced Accuracy: RPA bots perform reconciliations with a high level of accuracy, reducing errors and improving data integrity.

- Improved Controls: Automation eliminates manual intervention and enforces standardized processes, enhancing control over financial statements and reducing the risk of misstatements.

- Time and Cost Savings: RPA automation significantly reduces the time required for reconciliation, freeing up resources for more value-added activities. It also reduces the need for manual resources, leading to cost savings.

- Scalability: The RPA solution can handle a large number of internal balance sheet accounts, ensuring scalability as the bank's operations grow.

- Process Efficiency: Automation streamlines the reconciliation process, reducing the turnaround time and improving overall efficiency.

- Auditability: Automated processes provide an audit trail of activities, making it easier to track and review reconciliation activities for compliance and audit purposes.

- Data Insights: The automated reports and analytics provide valuable insights into the reconciliation results, allowing for proactive identification of trends or anomalies.

Overall, RPA automation enables the bank to overcome process challenges, enhance controls, improve efficiency, and achieve greater accuracy and scalability in the reconciliation of internal balance sheet accounts.