Auto Commentary

Situation

A Tier-1 global bank operating in 90+ countries faces challenges in timely book close and generating accurate reports. The CFO department with 300+ employees struggles with inefficiencies recognized in the financial industry. Research by McKinsey, Gartner, Forrester, BCG, and Bain highlights the complexity of financial processes, prone to errors and delays, leading to penalties for late submissions. Manual finance processes consume 25% to 40% of staff time on low-value tasks, hindering productivity and strategic focus. Automation and digitization, leveraging technologies like Natural Language Processing and rule-based transformations, can significantly improve efficiency, accuracy, and compliance while reducing costs.

Challenge

The manual report generation and book close processes consume significant time, leading to late submissions and penalties. McKinsey's research indicates that manual finance processes waste staff time, impacting accuracy and regulatory compliance. Gartner estimates potential cost savings of up to 50% through finance automation. Research by Forrester, BCG, and Bain emphasizes the need for automation, digital transformation, and adopting technologies like Natural Language Processing and advanced analytics to streamline finance operations, reduce errors, and enhance overall performance

Action

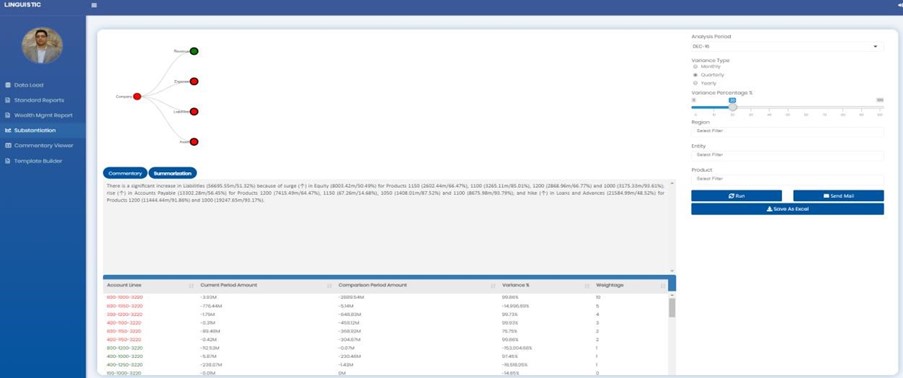

In response to the challenges faced in timely book close and report generation, the Tier-1 global bank takes proactive measures to implement an Auto Commentary Tool. The bank invests in advanced technologies such as Natural Language Processing (NLP) and rule-based transformations to automate the generation of Balance Sheet and PnL Reports. The tool is integrated with Oracle GL/SAP, enabling seamless data extraction and analysis. The implementation is initially tested on Management Hierarchy and later extended to Legal and Tax Hierarchy. Additionally, advanced analytical models are integrated to analyze balance sheet and PnL account lines, while account level ownership is mapped to trigger messages to account owners in case of variances.

Results

The implementation of the Auto Commentary Tool yields substantial benefits for the bank:

- Significant Time Savings: The tool reduces the time required to generate Balance Sheet and PnL Reports by an impressive 80%. The average time per report is reduced from 10 hours to just 2 hours. This leads to significant time savings, allowing finance teams to focus on more value-added activities.

- Enhanced Accuracy: By automating the report generation process, the tool reduces error rates by 90%. This improvement in accuracy minimizes the risk of erroneous financial reporting, ensuring compliance with regulatory requirements and enhancing the credibility of the bank's financial statements.

- Deeper Insights: The integration of advanced analytical models enables the tool to provide deeper insights into balance sheet and PnL account lines. This empowers finance professionals to make more informed decisions, identify trends, and uncover opportunities for financial optimization.

- Improved Communication and Collaboration: The tool's automated messages to account owners in case of variances enhance communication and facilitate faster resolution of discrepancies. This streamlines the collaboration between stakeholders and promotes efficient decision-making

- Cost Reduction: The automation of manual processes and the reduction in error rates lead to cost savings for the bank. By minimizing the need for manual intervention and avoiding penalties/fines for late submissions, the bank achieves greater operational efficiency and financial savings.

These benefits align with the research findings from leading consulting firms. McKinsey highlights the potential for significant time savings and improved accuracy through automation, while Gartner emphasizes the importance of adopting advanced technologies to drive cost reductions and operational excellence.

By leveraging the power of automation and advanced technologies, the bank not only overcomes its challenges in timely book close and report generation but also realizes tangible benefits that contribute to its overall success in the highly competitive global financial industry.