Automation of US Tax Form

Situation

The bank faces the challenge of retrieving information from US tax documents and automating the capture and review process. The current manual process is time-consuming, error-prone, and inefficient.

Challenge

The bank needs a solution to extract data from US tax documents accurately and automate the capture and review process. This will reduce manual effort, improve data accuracy, and enhance the overall efficiency of tax-related operations.

Action

The bank takes the following actions to design an optimized data flow for the intercompany process:

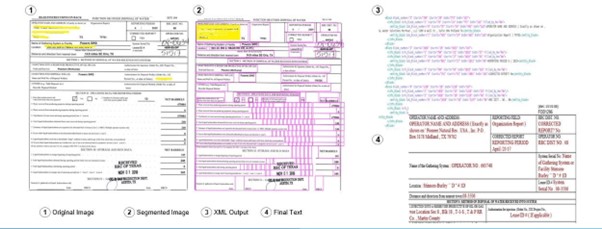

- OCR/OMR Solution: Develop an open-source Optical Character Recognition (OCR) and Optical Mark Recognition (OMR) solution capable of extracting data from various sections of the US tax forms.

- Data Extraction: Configure the OCR/OMR solution to accurately extract relevant data such as taxpayer information, income details, deductions, credits, and signatures from the tax forms.

- Validation and Verification: Implement validation checks to ensure the accuracy and completeness of the extracted data. Verify the data against predefined rules and perform data quality checks.

- Integration: Integrate the extracted data with the bank's front-end systems and Excel spreadsheets for downstream consumption and further processing.

- Exception Handling: Develop error handling mechanisms to address cases where the OCR/OMR solution encounters difficulties in extracting certain data fields. Implement manual review processes for these exceptional cases.

- Process Automation: Automate the capture and review process to minimize manual intervention and streamline the overall workflow.

- Audit Trail: Implement an audit trail mechanism to track and record the history of changes made to the captured data, ensuring traceability and compliance.

Results

The automation of the US tax form process brings significant benefits to the bank:

- Time and Cost Savings: The automated process reduces manual effort, allowing for faster processing of tax forms and reducing operational costs associated with manual data entry and review.

- Improved Accuracy: The OCR/OMR solution enhances data accuracy by eliminating human errors in data entry and reducing the risk of data discrepancies.

- Increased Efficiency: The streamlined workflow and automation minimize delays, improve turnaround time, and enhance overall process efficiency.

- Data Consistency: The integration with front-end systems and Excel spreadsheets ensures consistent and reliable data across different applications and platforms.

- Enhanced Compliance: The implementation of validation checks and audit trails helps ensure compliance with regulatory requirements and internal control standards.

- Data Insights: The availability of accurate and structured data allows for better analysis, reporting, and decision-making related to tax-related operations.

Overall, the automation of the US tax form process enables the bank to streamline operations, improve data accuracy, reduce costs, and enhance compliance, leading to more efficient and effective tax-related processes.