Account Payable Automation

Situation

The bank faces challenges due to manual processes and a lack of standardization in invoice processing, leading to delays in payouts and the deployment of over 100 operation support staff to handle the volume of invoices and cheques

Challenge

The manual processing of invoices and cheques is time-consuming, error-prone, and requires a large workforce. The bank seeks to automate and streamline the accounts payable process to improve efficiency and reduce operational costs.

Action

The bank implements the following actions to automate accounts payable:

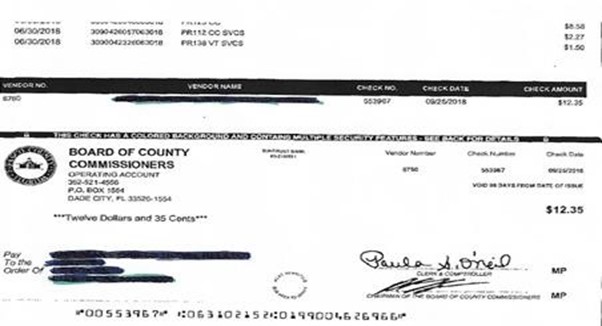

- OCR Solution: Develop an open-source Optical Character Recognition (OCR) solution capable of extracting information from invoices and cheques accurately.

- Information Extraction: Configure the OCR solution to extract relevant information such as invoice numbers, amounts, vendor details, and payment dates from invoices and cheques.

- Automation and Workflow: Implement automated workflows that route invoices and cheques through approval processes, matching them with corresponding purchase orders or contracts.

- Integration: Integrate the OCR solution with existing accounting systems to automatically populate invoice data and initiate payment processes.

- Exception Handling: Implement intelligent exception handling mechanisms to handle cases where the OCR solution encounters difficulties in extracting information accurately.

- Reporting and Analytics: Utilize data generated through the automated accounts payable process to generate reports and perform analytics, enabling insights into payment trends, vendor performance, and process optimization.

Results

The automation of accounts payable brings significant improvements to the bank's operations:

- Efficiency Gains: The automated process reduces manual effort and speeds up invoice processing, leading to faster payouts and improved cash flow management.

- Cost Savings: By eliminating the need for a large operation support staff, the bank achieves significant cost savings in terms of salaries, benefits, and office space.

- Error Reduction: The OCR solution improves accuracy and reduces errors associated with manual data entry, minimizing the risk of payment discrepancies and reconciliation issues.

- Process Standardization: The automated workflow enforces standardized processes, ensuring consistency in invoice handling and payment procedures.

- Enhanced Visibility: The integration with accounting systems provides real time visibility into invoice status, payment history, and cash flow, enabling better financial management.

- Data-driven Insights: The availability of comprehensive data allows for better analysis of vendor performance, payment patterns, and opportunities for optimization.

Overall, the accounts payable automation initiative enables the bank to streamline processes, reduce costs, improve accuracy, and gain valuable insights, ultimately enhancing operational efficiency and financial management