Data Validation Across KYC and Form

Situation

The bank faces the challenge of retrieving information from the account opening form and KYC (Know Your Customer) documents provided by customers. The bank needs to validate the documents by matching the information in the account opening form and KYC, ensuring accuracy and compliance. Additionally, the bank needs to validate the KYC documents by linking them to the Central KYC (CKYC) database.

Challenge

The manual process of validating account opening forms and KYC documents is time-consuming, error-prone, and lacks efficiency. The bank requires an automated solution to extract data from these documents, validate the information, and link the KYC documents to the CKYC database for verification.

Action

The bank takes the following actions to automate data validation across KYC and form:

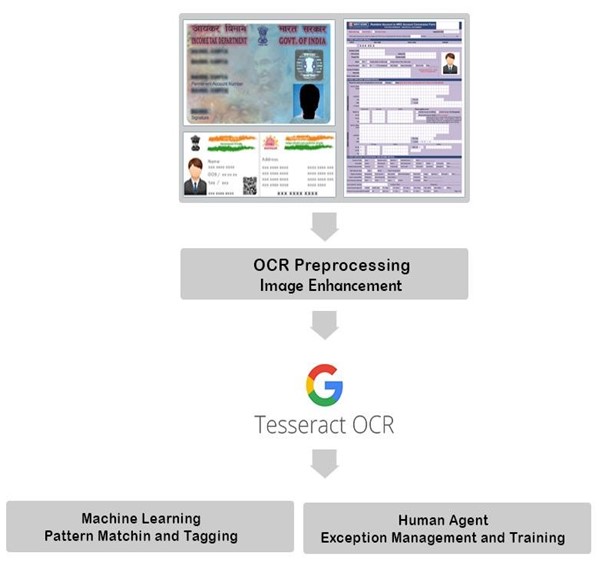

- OCR Solution: Develop an open-source Optical Character Recognition (OCR) solution capable of extracting data from account opening forms and various KYC documents such as Aadhar cards, passports, and PAN cards.

- Data Extraction: Configure the OCR solution to extract relevant data fields from the account opening form and KYC documents, including name, date of birth, address, and other required information.

- Database Integration: Integrate the extracted data with a database to store and manage the captured information for validation and matching purposes.

- Data Matching: Implement matching algorithms to compare the extracted data from the account opening form and KYC documents, identifying any discrepancies or inconsistencies.

- CKYC Verification: Link the KYC documents to the CKYC database to validate the provided information and ensure compliance with regulatory requirements.

- Exception Handling: Develop a mechanism to handle cases where the OCR solution encounters difficulties in extracting certain data fields or when validation discrepancies are found. Implement a manual review process for these exceptional cases.

- Error Reporting: Generate error reports for any discrepancies or validation failures, highlighting the specific fields or documents that require further attention or review.

Results

The automation of data validation across KYC and form yields significant results for the bank:

- Increased Efficiency: The automated process reduces manual effort and accelerates the validation process, leading to faster customer onboarding and improved operational efficiency.

- Enhanced Accuracy: The OCR solution improves data accuracy by eliminating manual data entry errors, ensuring the extracted information is captured correctly.

- Regulatory Compliance: The integration with the CKYC database ensures compliance with regulatory requirements for KYC verification, reducing the risk of non-compliance penalties.

- Improved Customer Experience: The streamlined validation process enables a smoother onboarding experience for customers, minimizing delays and providing a more efficient service.

- Data Consistency: The integration with the database ensures consistent and reliable data across different customer information sources, enhancing data integrity.

- Error Identification: The error reporting mechanism helps identify and address discrepancies or validation failures promptly, enabling timely resolution and maintaining data accuracy.

Overall, the automation of data validation across KYC and form enables the bank to improve efficiency, accuracy, compliance, and customer experience in the customer onboarding process.