Auto Matching

Situation

The bank aims to enhance operational efficiencies by reducing the Full-Time Equivalent (FTE) footprint associated with manual matching of Open Items.

Challenge

Despite the implementation of a matching and reconciliation tool, the bank continues to face challenges in handling the remaining 10-20% of open items, primarily due to high trade and payment volumes. These open items require extensive manual effort and become difficult to manage effectively

Action

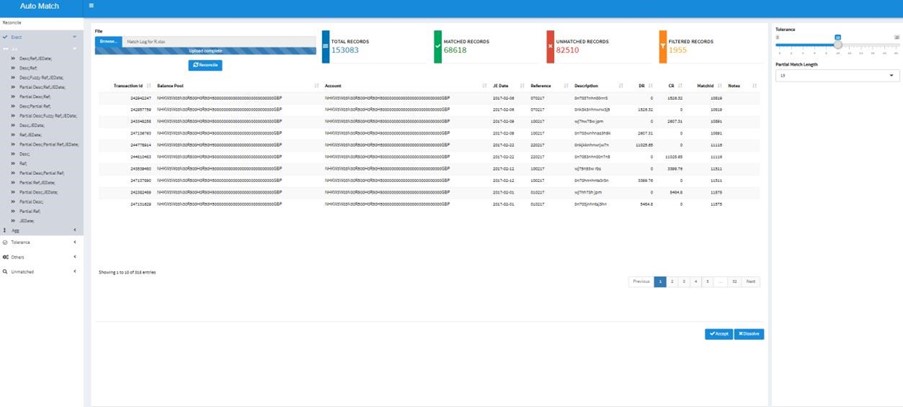

To address this challenge, the bank develops an AI/ML-based Auto Match Tool. This tool leverages advanced algorithms and machine learning models to automate the matching process for open items. By analyzing the open items report from the General Ledger (GL), the tool applies a range of ML techniques such as Exact, Tolerance, and Aggregate Matches. It utilizes regex, patterns, and other ML methodologies to perform matching, including one-to-many matches. To ensure the accuracy and reliability of the tool, the matching rules are thoroughly tested for repeatability and validated by subject matter experts (SMEs) from the business.

Results

The implementation of the Auto Match Tool delivers significant results. It successfully matches 80-90% of the open items, thereby reducing the manual effort required for reconciliation. The remaining 10-20% of open items become more manageable, resulting in a remarkable 50% reduction in FTE requirements. The Auto Match Tool brings about improvements in operational efficiency, accuracy, and overall reconciliation processes, leading to streamlined operations and enhanced productivity within the bank.