Design of Data Flow for Intercompany Process for Tier 1 Bank

Situation

A tier 1 bank needs to establish a robust data flow and information architecture for the intercompany process.

Challenge

The existing intercompany process lacks efficiency and transparency due to fragmented data flow and a lack of standardized procedures. The bank requires a well-designed data flow and information architecture to streamline the intercompany process.

Action

The bank takes the following actions to design an optimized data flow for the intercompany process:

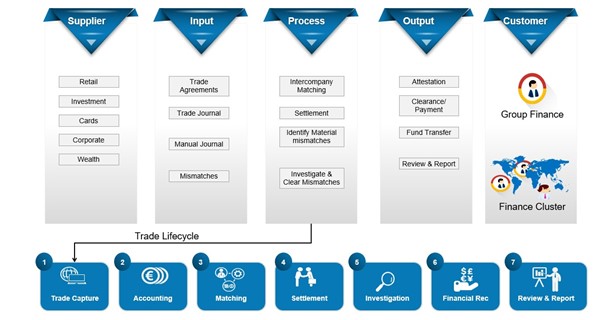

- Architecture Design: Develop an architecture that defines the components, systems, and data flows involved in the intercompany process.

- Information Architecture: Design an information architecture that defines the structure, storage, and accessibility of intercompany data.

- Data Model: Create a comprehensive data model that captures the intercompany relationships, transactions, and relevant attributes.

- Integration: Implement integration mechanisms to facilitate seamless data exchange between systems involved in the intercompany process.

- Data Governance: Establish data governance principles and practices to ensure data quality, consistency, and security throughout the intercompany data flow.

- Automation: Identify opportunities for automation and implement appropriate technologies to streamline manual tasks and improve process efficiency.

Results

The design of the data flow for the intercompany process brings significant improvements to the bank's operations:

- Improved Efficiency: The streamlined data flow and standardized procedures reduce manual effort, resulting in faster and more accurate intercompany transactions.

- Enhanced Transparency: The well-defined data model and information architecture provide a clear view of intercompany relationships, improving transparency and auditability.

- Data Integrity: The implementation of data governance principles ensures data quality, consistency, and security, minimizing the risk of errors and discrepancies.

- Process Optimization: Automation of manual tasks eliminates bottlenecks and reduces processing time, leading to improved overall process efficiency.

- Seamless Integration: The integration mechanisms enable smooth data exchange between systems, eliminating data silos and enhancing data consistency.

Overall, the design of the data flow for the intercompany process transforms the bank's operations, enabling efficient, transparent, and reliable intercompany transactions.